Lower after-tax cost

There are several tax advantages of owning life insurance inside a corporation. The first is the lower-after tax cost of premiums. To pay a $1000 premium a high income earner taxed a 48% would need to earn $1923 whereas the corporation taxed at 12.5% would need to earn only $1142

Passive income rules

The 2018 federal budget introduced a $50,000 cap on passive income. The effect is that income earned in excess of $50,000 will grind down the small business deduction of $500,000 that provides a lower tax rate of 12.5% and result in higher taxation. One strategy to keep passive income under this threshold is for the business to purchase a permanent life insurance policy on the business owner where the cash in the policy grows tax exempt.

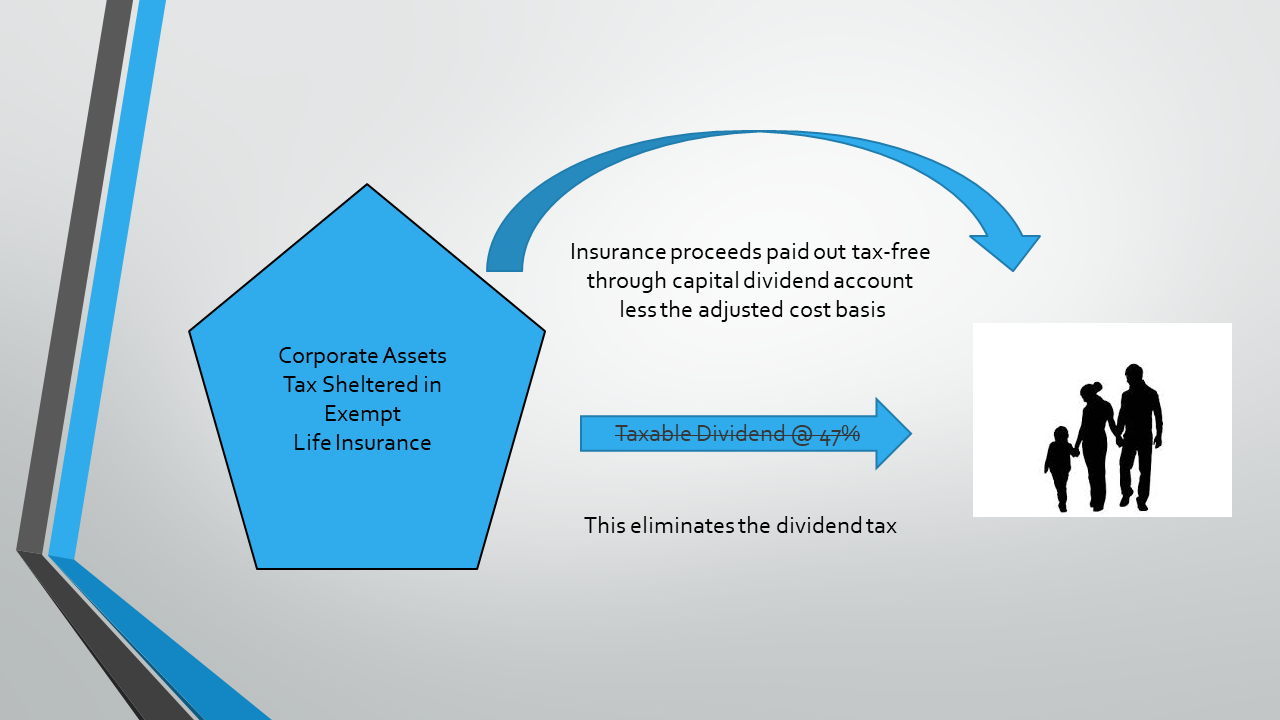

Eliminate a layer of taxation

The death benefit of a corporately owned life insurance flows out of the corporation tax-free through the capital dividend account (less the adjusted cost-base if applicable) rather than being paid out as a fully taxable dividend. Permanent life insurance is attractive to a business owner who has excess funds in the company and wants a conservative tax-deferred investment and who is also interested in maximizing their estate.