Planning one’s estate is important because it helps minimize taxation and makes certain that your assets got to you family and friends, or charitable organisation in accordance with you wishes thereby avoiding headaches and problems for those left to settle your estate.

There has been much talk in the media regarding probate fees and new rules and liabilities that face an executor in Ontario. For many older Canadians, there is a great interest in estate planning.

Probate fees in Ontario are the highest in the country and will cost an estate approximately 1.5% of the estate’s value.

What many people forget is that executors can charge up to 5% of the value of the estate.

Executor’s compensation is based on provisions set out in provincial trustee legislation which generally is what is “fair and reasonable”.

Generally, in most provinces the percentage guidelines are as follows:

1) 2.5% charged on capital receipts;

2) 2.5% charged on capital disbursements;

3) 2.5% charged on revenue receipts;

4) 2.5% charged on revenue disbursements; and

5) if the estate is not immediately distributable, an annual care and management fee of 2/5 of 1% on the gross value of the estate. (This is only available where the estate or part of it is to be held in trust and not distributed to the beneficiaries within the year).

The legal fees to probate a will may run from $10,000 to $15,000 and when combined with probate and executor fees it adds up. A $500,000 estate can expect to pay over $40,000 in fees.

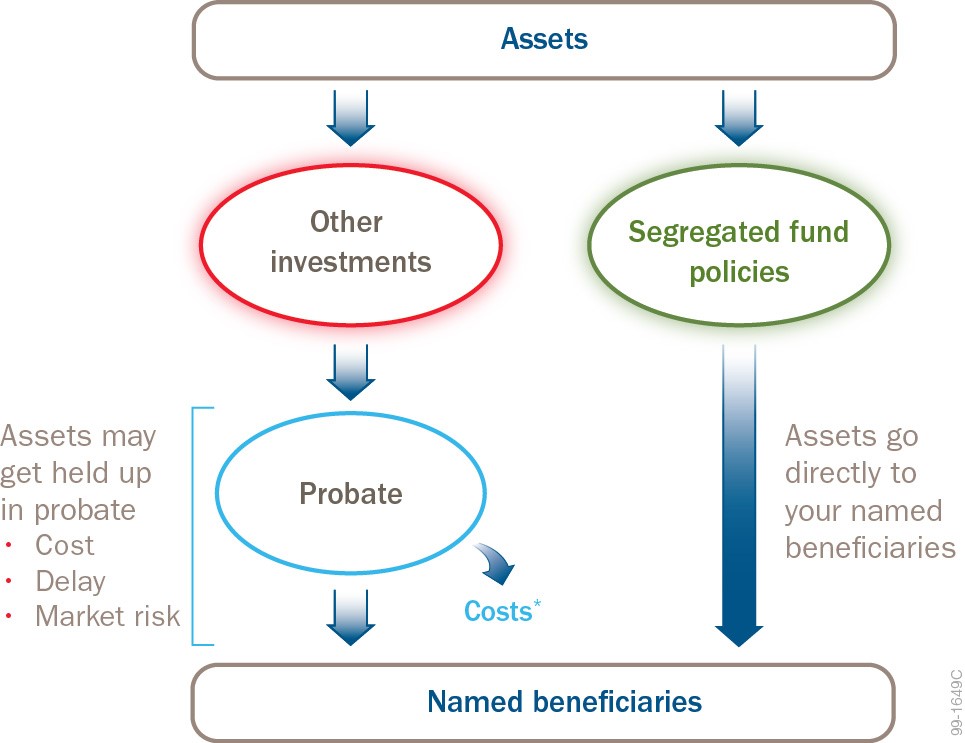

The best estate planning may be the plan that sends your assets directly to your beneficiaries and by-passes the estate all together. Professional advice in this matter is important.

One over-looked strategy to minimize fees and estate taxes is the use of segregated funds. Segregated funds are investments held at a life insurance company. Funds held at an insurance company are technically an insurance contract and as such the owner can name a beneficiary. Upon the death of the owner the funds will pass directly to the beneficiary, privately, outside of the owner’s estate.

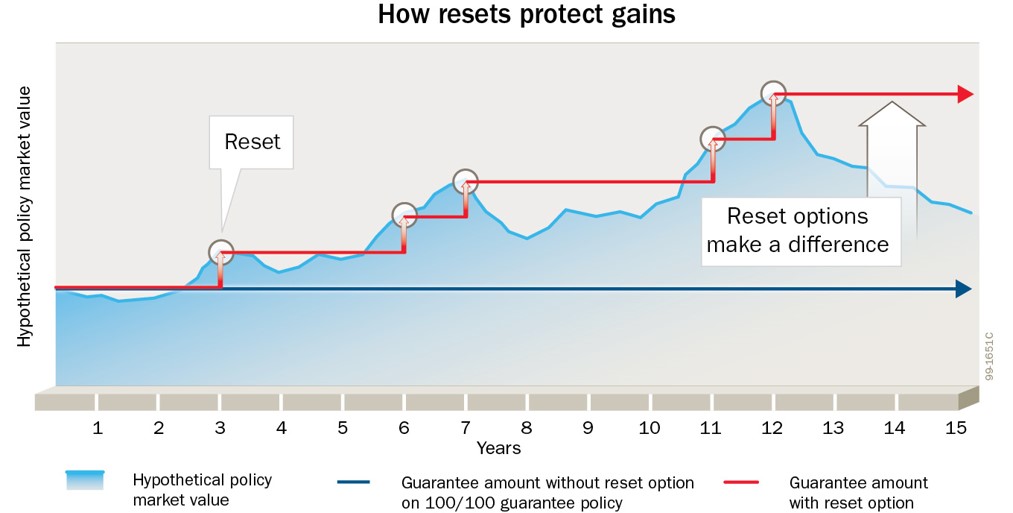

Segregated funds offer cash and guaranteed interest accounts with terms from 1 to 15 years at competitive rates. Segregated funds also offer investments very similar to mutual funds and include guarantees to protect the principal with death benefit and contract maturity guarantees in the event of a drop in the stock markets. Many segregated funds also offering the ability to “lock-in” stock market gains using the Re-set segregated contract feature.

To learn more about segregated funds and to order your free copy of Estate Planning using Segregated Funds please contact Nick Godfrey 905-815-7186