I wanted to remind you of two important features of term life insurance.

Term life insurance policies are typically both renewable and convertible and these nifty features are built in to most term life insurance contracts.

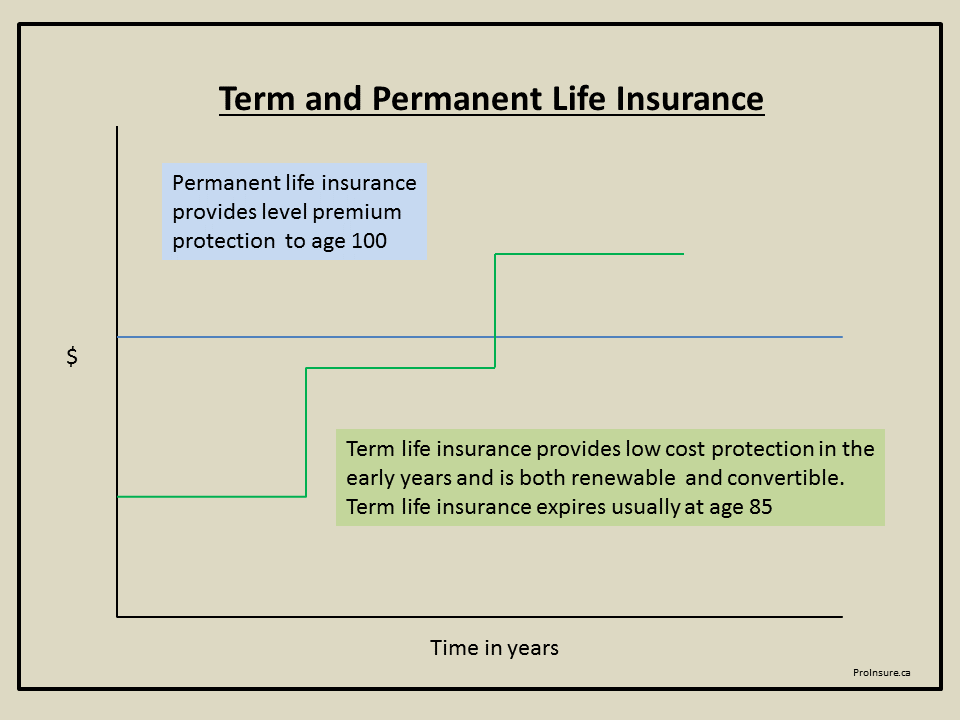

Let’s first talk about what makes the insurance protection renewable. Term life insurance increases in cost at the end of each term. The terms are typically 10 and 20 years terms. The premium changes are written in the policy and are guaranteed. This means that with a ten year term policy that the premium will increase in the 11th year and on the 21st year if you have a twenty year term. Each time the premium increases we call it a “renewal”.

The cost of insurance climbs in price similar to a climbing stairs. The older you become the more expensive the insurance. The good news is that your protection remains in force as long as you continue to pay the premium. The bad news is that the guaranteed premium under the contract is much higher than the market rate. The reason is the price is high is that the insurer guarantees the protection regardless of the health of the life insured.

One solution to avoiding the high cost of automatically renewing after a term is completed is to re-apply for the protection. Re-applying means a new application is required and new medical evidence will be collected.

The insurer views this new policy as a new risk and charges lower rates than the renewal rates offered in the existing policy.

Once the new policy is approved, the old policy is cancelled.

Another solution to avoiding the increasing premiums of term insurance is to convert some of the protection to a level premium permanent policy.

We will explain the benefits of converting term protection to permanent protection in a future email.